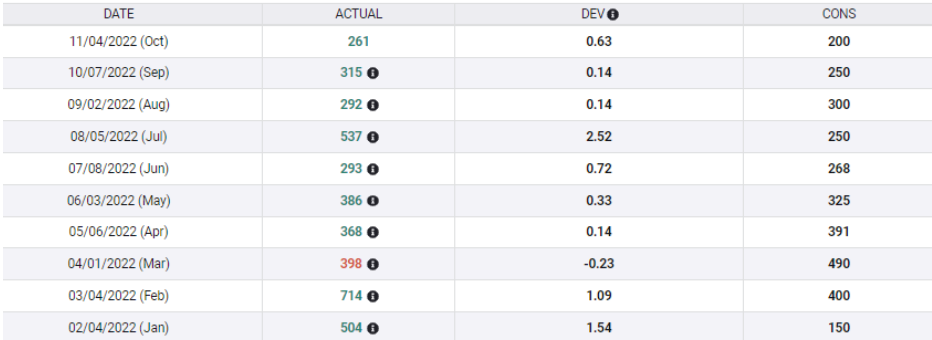

- Investors anticipate an increase in employment of 200,000, down from 261,000 in October.

- Real projections have been further reduced by weak ADP data.

- It could be necessary to rectify the massive Dollar selling that followed the Fed’s dovish announcement.

- Given the general trend, a positive NFP might cause a brief rebound in the dollar.

A pre-pandemic level of employment increases, or about 200,000, is expected to be shown in the most recent Nonfarm Payrolls announcement. possibly lower. I do anticipate another pleasant surprise, one that will result in a brief dollar rebound.

After ADP released a dismal gain of just 127,000 private-sector positions on Wednesday,’real’ expectations have decreased. For October, the data from America’s top payroll supplier proved to be reliable, and its data had an influence on expectations. Around 150,000 is probably the range.

The ISM Manufacturing PMI also has a negative employment component, which fell to 48.4 points, further into contraction zone.

However, it’s important to remember that the NFP typically exceeds expectations. The number has a winning streak when compared to economists’ predictions; seven times in a row and eight out of ten times this year, data have exceeded predictions.

But even if the result is less than 200,000 or 150,000, that it would still represent a temporary gain for the Dollar.

Why dollar gain? The recent decline in the value of the dollar is mostly attributable to Jerome Powell, the chairman of the Federal Reserve, and his dovish remarks. He declared that neither the Fed nor its monetary policies were intended to be overly strict. Though the measure was justified, it could have gone too far.

That suggests to me the possibility of an impending upward correction in the dollar, if the NFP is not too low. I only consider a read below 100,000 to be detrimental to the dollar.

Why is it only temporary? Given the belief that inflation has already peaked, the overall trend in the world’s reserve currency is downward, and the Fed is aware of this development.

Market Scenarios

Baseline case is that the NFP will come in between 150,000 and 200,000 higher than genuine expectations, causing the Dollar to briefly rise. From there, it can start to decrease again. Such a two-sided shift would probably occur even with a read of 250,000. This result is likely to happen.

An alternate scenario is an increase of less than 100,000 positions, which would cause the Dollar to flatline. It has a medium likelihood.

Only if the NFP exceeds expectations by more than 300,000 positions, a figure that would contradict the Fed’s dovish approach, do I anticipate persistent Dollar gain. There is little chance of this happening.

What would occur if the US announced employment losses? A negative reading on the NFP would be concerning and might lead to concerns about global growth, which would lead to safe-haven funds flowing into the dollar. This result has a low likelihood.

Final thoughts

Markets’ optimism is putting pressure on the dollar because they perceive the glass as half full. The NFP may nonetheless cause a brief correction prior to the next decline.

The final day for Fed officials to publicly speak before their “blackout period” before a decision is the Saturday after the NFP. There will probably be increased volatility as a result.